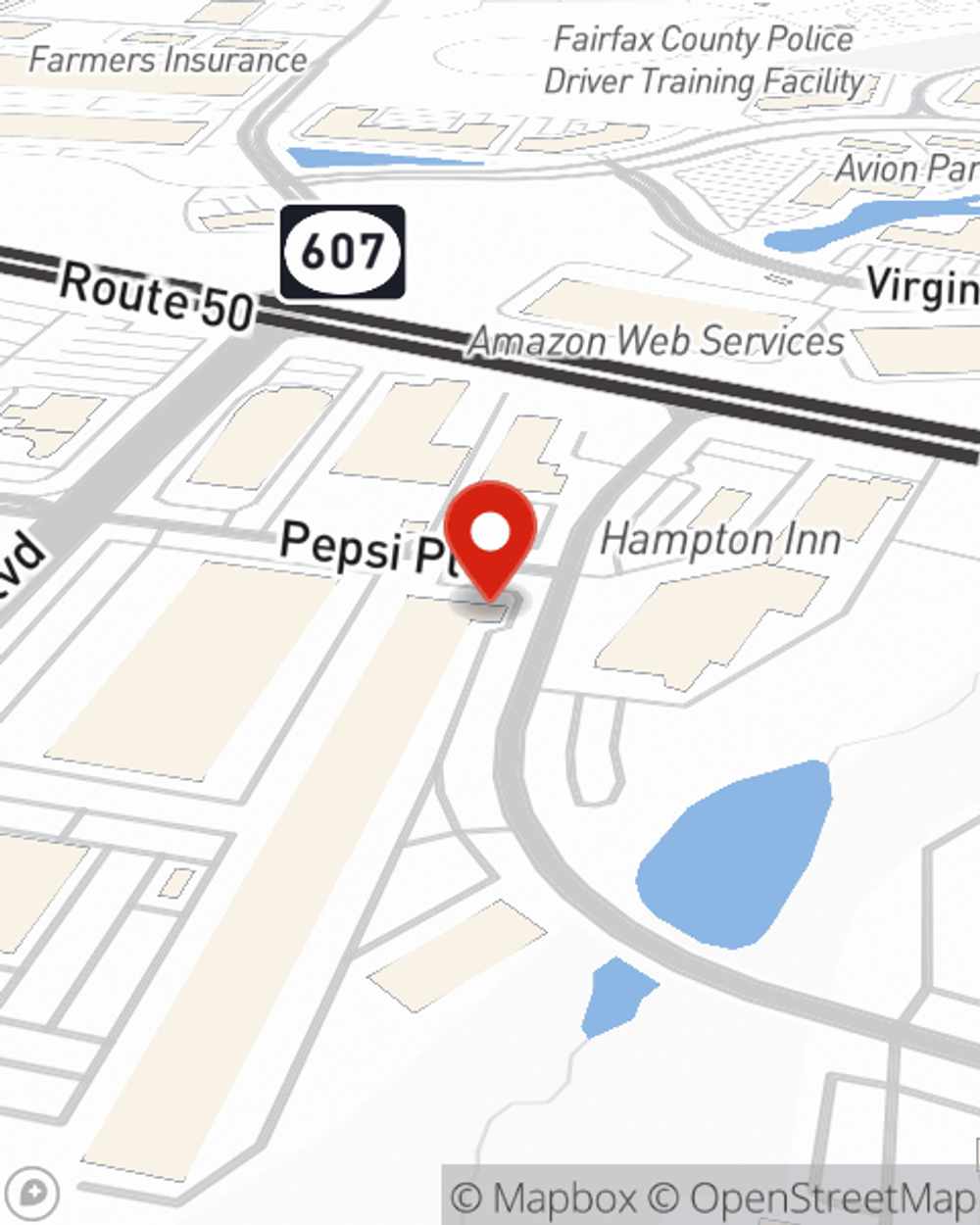

Business Insurance in and around Chantilly

One of Chantilly’s top choices for small business insurance.

This small business insurance is not risky

Your Search For Great Small Business Insurance Ends Now.

Operating your small business takes commitment, creativity, and terrific insurance. That's why State Farm offers coverage options like errors and omissions liability, business continuity plans, a surety or fidelity bond, and more!

One of Chantilly’s top choices for small business insurance.

This small business insurance is not risky

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a kennel, a drug store, or a beauty salon, having the right protection for you is important. As a business owner, as well, State Farm agent Hussain Saleem understands and is happy to offer customizable insurance options to fit what you need.

Call Hussain Saleem today, and let's get down to business.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Hussain Saleem

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.